Intelligent Investing.

Real Returns.

Access equities, funds, and structured investment strategies built for performance, transparency, and long-term capital growth.

4.9

From 120+ Reviews

Equity Portfolios

Diversified stock portfolios targeting sustainable growth across global markets, sectors, and market capitalizations.

Managed Investment Strategies

Professionally structured strategies designed to adapt to market cycles while controlling downside risk.

Market-Driven Allocation

Dynamic asset allocation based on market trends, volatility signals, and macro indicators.

Secure Asset Protection

- About us

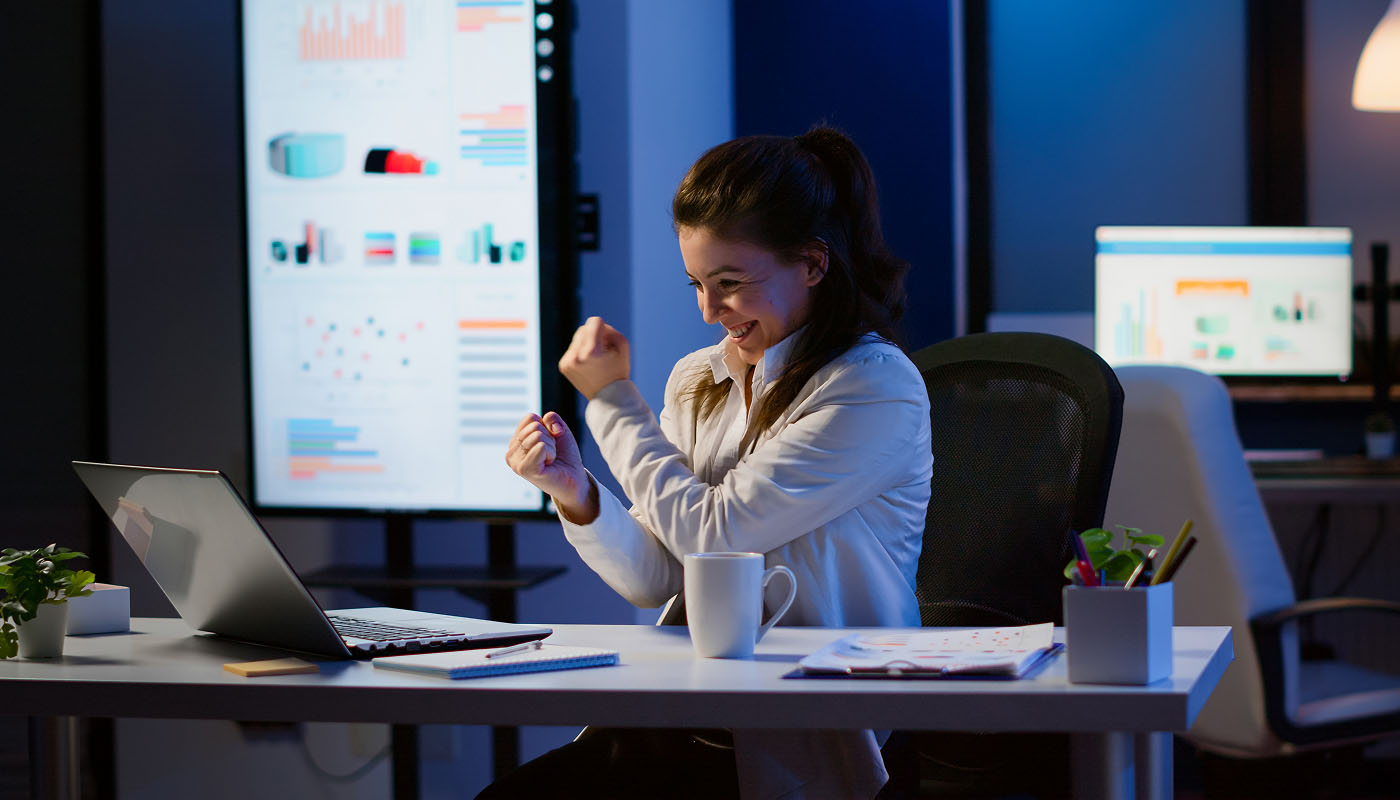

A Reliable Partner Committed to Your Financial Success

HedgeFlux is an investment platform focused on stocks, securities, and portfolio strategies designed to balance growth with disciplined risk management. Every strategy is backed by market data, clear logic, and defined exposure limits. No hype. No shortcuts. Just structured investing.

“Markets don’t reward noise — they reward discipline. HedgeFlux was built to give investors structure, clarity, and risk control in an environment that often lacks all three.”

5

Daniel Mercer

Chief Executive Officer, HedgeFlux

Trusted by top companies

155K Active Clients

HedgeFlux strategies are designed to perform across different market conditions, not just bull runs.

- Financial solutions

Personalized Financial

Guidance Rooted in

Core

Values

HedgeFlux is a structured investment firm that offers data-driven investment strategies, portfolio management frameworks, and disciplined risk-focused investing solutions. We blend quantitative research, risk engineering, and market insight to support investors seeking long-term capital appreciation without sacrificing risk discipline.

- Our Services

Empowering Financial Growth

We provide tailored financial solutions to help your business thrive with clarity and confidence.

Time Savings

Reduce financial admin tasks by 50% with automation and streamlined accounting workflows.

Increased Profitability

Businesses partnering with us achieve up to 30% higher financial efficiency through smart planning and tax optimization.

Financial Growth with Expert Advisory

Risk Reduction

82% of financial risks are preventable — our advisory helps protect your business stability and growth.

- Our Services

Exploring Our Global Finance Network

Discover how our global community connects investors across regions, sharing a unified vision and driving financial progress at scale.

Experience

Portfolios Managed

Prestigious Awards

Clients Satisfaction

- Who we are

Why leading businesses trust our financial expertise

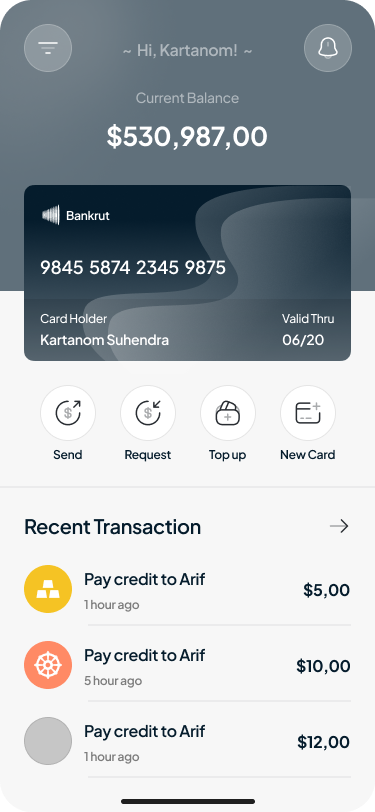

Choose a Strategy 01

Select from equity-based or diversified investment strategies.

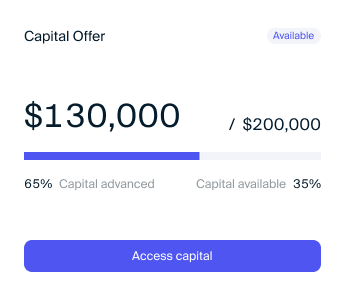

Allocate Capital 02

Invest with full visibility into strategy structure and risk profile.

Active Management 03

Portfolios are monitored and adjusted based on market conditions..

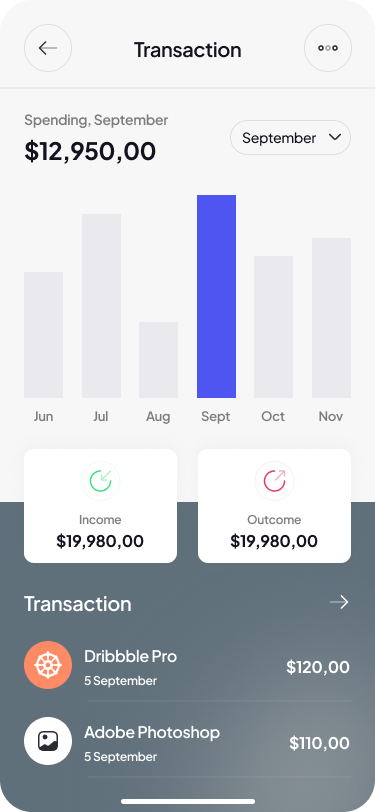

Track Performance 04

View real-time performance, historical data, and detailed reports.

HedgeFlux has transformed how I approach portfolio allocation. The strategies are clear, data-focused, and stress tested across market conditions. I finally feel in control of my long-term planning.

As a chartered financial analyst, I’ve seen many platforms. HedgeFlux combines institutional rigor with accessible execution, a rare combination.

I appreciate the transparency. Every strategy comes with documented logic and risk parameters, so I’m not guessing what I own.

- Insights

Market Insights,

Investment Perspectives

Risk Management Is Not Optional in Modern Investing

Returns attract attention, but risk determines survival. We explore how professional investors define risk, manage drawdowns, and build strategies designed to withstand volatility, not just benefit from bull markets.

Active vs Passive Investing: The Debate Most People Get Wrong

This isn’t about choosing sides. It’s about understanding when active management adds value and when passive exposure makes more sense — and how combining both can improve long-term performance.

- Contact us

Have

questions?

Get in touch!

- faq

Financial

Planing

FAQ’s

4.9

Overall Ratings

Is HedgeFlux suitable for beginners?

Yes, Each strategy includes clear explanations, risk levels, and performance data.

Can I withdraw anytime?

Short answer, Yes. Withdrawal terms depend on the selected strategy and are clearly stated upfront.

How are strategies managed?

Strategies are managed using predefined rules, market data, and continuous oversight.

Are returns guaranteed?

No. Investing involves risk. HedgeFlux focuses on structured risk management, not guarantees.